Price and yield assumptions

Orchard-gate prices were assumed higher, and fruit quality on average better and more uniform compared to the more traditional Packhams pear.

Based on a consumer preference survey and observed premiums for the parent cultivar (Corella) we assumed a price premium of 20% for Deliza.

With good sized fruit (averaging 200 gm), packout was assumed to be 90% (70% class 1 and 20% class 2).

The average farm-gate price (net of pack-house costs) averaged over all classes used in the analysis was $530/t ($1440/t gross).

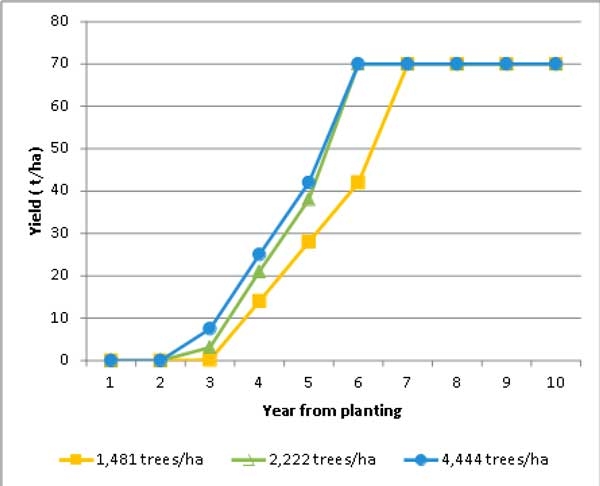

Trees in the field experiment started producing in the third year after planting and achieved modest marketable yields of 0.15, 3.05 and 7.48 t/ha, respectively for plantings of 1481; 2222 and 4444 trees/ha.

Production is expected to increase rapidly to reach a maximum in year six or seven (Figure 1). Due to the varying number of leaders per tree, yield at full bearing is expected to even out at 70 t/ha (with a possible upper limit of 90–100 t/ha).

This compares to about 40 t/ha for traditional plantings of Packhams at full bearing, that typically occurs in year ten.

Results

Based on the assumptions discussed earlier, the ‘economic feasibility’ (or profitability) and the ‘financial feasibility’ (or liquidity) of investing in the new red-blushed pears varies depending on the scenario (Table 1).

The NPV for the ‘Base’ scenario (Scenario 1) for a planting density of 2,222 trees/ha averaged $210,613 over 30 years, in the range $165,888 to $257,175.

The NPV and the lower 90% confidence interval are both greater than zero indicating a profitable investment.

The modified internal rate of return (MIRR) averaged 8.7%, in the range 8.1% to 9.3%.

These results indicate that growers can invest in the new pears with confidence.

Debt peaked at approximately $89,083 in year three, and the investment broke even in year nine.

Sensitivity analysis

Sensitivity analysis (Scenario 2–5 in Table 1) suggested that a 10 percentage-point increase in the price premium, bringing the price up to $990/t net, or an increase in the yield in year three to 10 t/ha would have the most positive effect on both profitability and liquidity, with the pay-back period dropping back to year eight.

In contrast, a delay by one year in achieving full yield potential (Scenario 4) has the most adverse effect on the economic performance metrics.

(continued next month)

See this article, tables and graphs in Tree Fruit March 2017